Ways to Give

Invest in a Dream. Invest in the Future.

You matter. Your donation matters.

Student access and success is our top priority. Support from alumni, faculty and staff, students, community friends and businesses is key to achieving and providing a high quality education for our students.

Your gift today helps support:

- Student scholarships

- Campus upgrades and enhancements

- Innovative curriculum and new technology

Ways to Give

Gifts in any amount are welcomed. Every gift, large and small, makes a tremendous difference in the lives of our students and community.

Thank you.

Mail: Checks should be made payable to the SUNY Schenectady Foundation, Inc., and sent to: 78 Washington Avenue, Schenectady, NY 12305

Online: Safe and secure online giving puts your donation to work immediately. All major credit cards accepted. Donate now.

Phone: Charging your credit card is quick and easy. All major credit cards accepted. Call the Foundation at 518-381-1324. Monday – Friday from 8:30 a.m. to 4:30 p.m. EST.

In-Person Gifts: We would love to have you visit the Foundation office on campus in Elston Hall, Room 120.

Matching Gift Program: Many companies offer a matching gift program. Your gift will go further with a matching gift. Please contact your Human Resources Department for more information.

Establish a scholarship: Please call our office at 518-381-1324 and we would be pleased to give you more information. Monday – Friday from 8:30 a.m. to 4:30 p.m. EST

Gifts of Stock: A gift of appreciated stock is a way to make a significant gift while saving capital gains and income taxes as well. Please call our office at 518-381-1324 and we would be pleased to assist you.

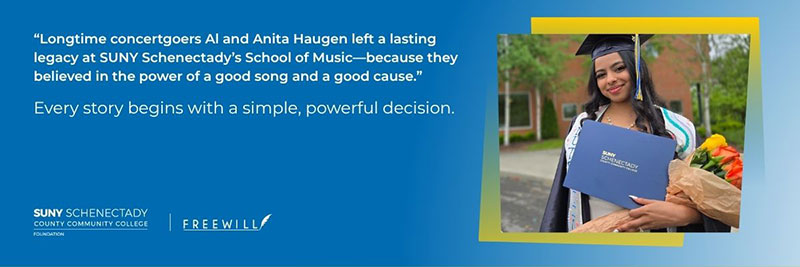

Legacy Giving: Consider making a significant and lasting gift through your will, charitable trust, life insurance or other form of charitable giving. To help you get started on your plans and legacy, we are offering FreeWill, an online tool that guides you through the process of creating your will or trust. It’s easy to use, accessible online and can be completed in 20 minutes. You can use this FreeWill resource on its own, or use it to document your wishes before finalizing your plans with an attorney.

Have you already included a gift in your will or trust? Please fill out this form to let us know! We would love to thank you for your generosity.

Do you have an IRA, 401(k), life-insurance policy, or any other assets not included in your will? If so, these are called non-probate assets and you must plan your beneficiaries for them separately. Use this online tool to make your plans and designate us as a beneficiary of one or more of these assets.

Tax ID#: 23-7194187